|

|

| This page is Bobby

Worldwide Approved for Section 508.

|

|

|

|

|

Consumer Watch

Still Getting Punished for Being

Poor

BOB RICHARDS

The Capital Times (Madison, WI), March 8, 2003

|

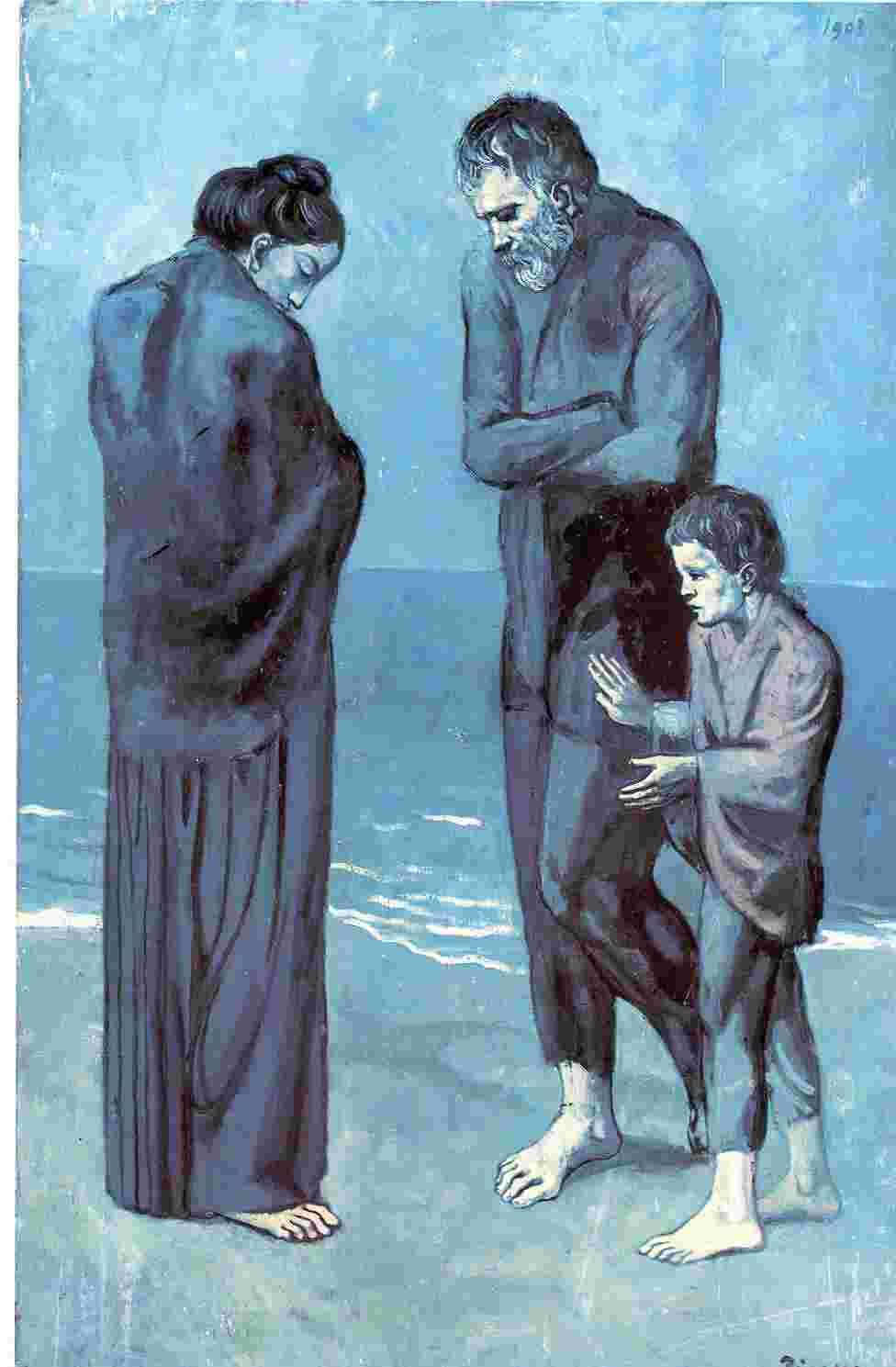

Poor People on the Shore,

Poor People on the Shore,

by Pablo Picasso (1903).

|

It costs a lot of money to be poor in

America.

Bankruptcy, check cashing and payday loan stores, credit reporting

inaccuracies, and predatory lending all were frequent topics as

activists recently gathered for the Consumer

Federation of America's Consumer Assembly, the nation's largest

annual meeting of consumer advocates.

"The Republican majority is going to again introduce a punitive

bankruptcy bill," House Minority Leader Nancy Pelosi, D-Calif.,

told the group. "Now with the economy in worse shape with many

more people out of work, the harsh impact of this legislation will

be more widely felt than it would have been last year."

But Sen. Orrin Hatch, R-Utah, defended the measure at a different

session, saying the bankruptcy system needs to be fixed because it

allows wealthy people to abuse the system.

Rep. Harold Ford Jr., D-Tenn., told the group that after having

trouble correcting a mistake he found in his credit report, he

learned that many of his constituents also had experienced that same

problem.

"The other person also had my name," he explained,

"but Harold was spelled differently. I thought it was

inherently unfair that when the credit-reporting agency received

information about me, they didn't go check it out. Hopefully before

this Congress is up we will take some action."

The impact of a 1999 federal law that required all federal payments

to be transferred electronically has meant that many low-income

consumers pay higher fees to obtain their federal benefit checks,

according to Philadelphia Legal Services attorney Irv Ackelsberg.

One argument for the direct deposit law was that it would get

everyone into the banking system, but Ackelsberg said, that wasn't

implemented. Instead many low-income consumers still depend on

check-cashing stores.

Ackelsberg said one check-cashing firm near his office offers direct

deposit through a relationship with a bank, but you still must go to

the check-cashing store to get your money. The required fees include

a $14.50 enrollment fee, a $1 per month maintenance

fee, and then a check-cashing fee of $1.95.

"What they do is turn that electronic transfer into a paper

check," Ackelsberg said. "It used to be that you got a

check and then paid a fee to cash it. Now you have to pay to get the

check and then you still have to pay a fee to cash it."

In another case, he said, a check-cashing store charged his client

$11 per month to have an automatic teller machine card, as well as

$2.50 for each deposit into the account and $1 for each withdrawal.

Consumer Product

Safety Commission Chairman Hal Stratton told the group that

all-terrain vehicles, arsenic-treated wood, and baby bath seats are

some of the products now under scrutiny by his agency. ATVs, he

said, continue to cause approximately 11,000 injuries each year.

While consumers continue to face increasing challenges in finding

safe and reliable products, they now are also seeing their ability

to pursue remedies to problems threatened by binding

arbitration clauses, according to attorney Michael Quirk of Trial

Lawyers for Public Justice.

More and more consumers, Quirk says, are discovering that they must

submit their disputes to a private arbitrator who is not obligated

to follow the existing law in his or her decision.

Sen. Hillary Clinton, D-N.Y., told the group that tougher food

safety standards are needed, especially in the area of ready-to-eat

products.

"USDA and FDA have provided guidelines to at-risk consumers

such as pregnant women, yet none of this information is provided on

a package label," she said. "If the meat industry cannot

provide assurances that food is truly ready to eat for all

consumers, then

the product should bear a label warning at-risk consumers of their

risk."

Clinton says she will co-sponsor legislation with Sen. Tom Harkin,

D-Iowa, designed to set stronger performance standards for the meat

and poultry industry.

-- Bob Richards is a Madison-based

consumer advocate. He's the author of It's in the Fine Print.

|

|

|